Single Premium Endowment Plan (T-917)

LIC Single Premium Endowment Plan (T-917) is a savings cum protection plan, where premium is paid in lump sum at the outset of the policy. This combination provides financial protection against death during the policy term with the provision of payment of lump-sum at the end of the selected policy term in case of his/her survival. This plan also takes care of liquidity needs through its loan facility.

Why Should I INVEST:

- Cover wide age group from 90 Days to 65 years.

- Single Premium Plan Means No Future Premium Burden.

- Best Gift to Child from Parents / Grand Parents to Ensure His / Her Education and Marriage Expenses.

- Eligible for Bonuses and Final Addition Bonuses declared by LIC.

- The Policy Can Be Surrendered At Any Time During The Policy Term.

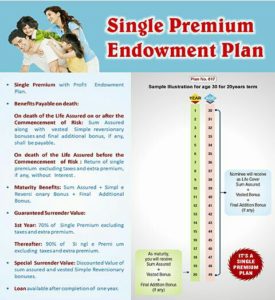

- Loan Facility Is Available Under This Plan After Completion Of One Policy Year.

Maturity Benefit:

- On completion of policy term, Sum Assured + Bonus + Final Addition Bonus will be paid as maturity.

Death Claim Benefit:

- On Death After Commencement Of Risk: Sum Assured + Vested Bonus + FAB if any, On Death Before Commencement Of Risk: Return Of Single Premium.

Eligibility Criteria:

| Minimum Age to Apply | 90 Days (Completed) |

| Maximum Age to Apply | 65 Years (Nearest Birthday) |

| Policy Term (Premium Payment Term) | 10 to 25 Years |

| Maximum Maturity Age | 75 Years |

| Premium Paying Mode | Single Premium Plan |

| Basic Sum Assured | 50000 and above |

| Loan | After 1 year |

| Surrender | At Any Time |