LIC Sales Training

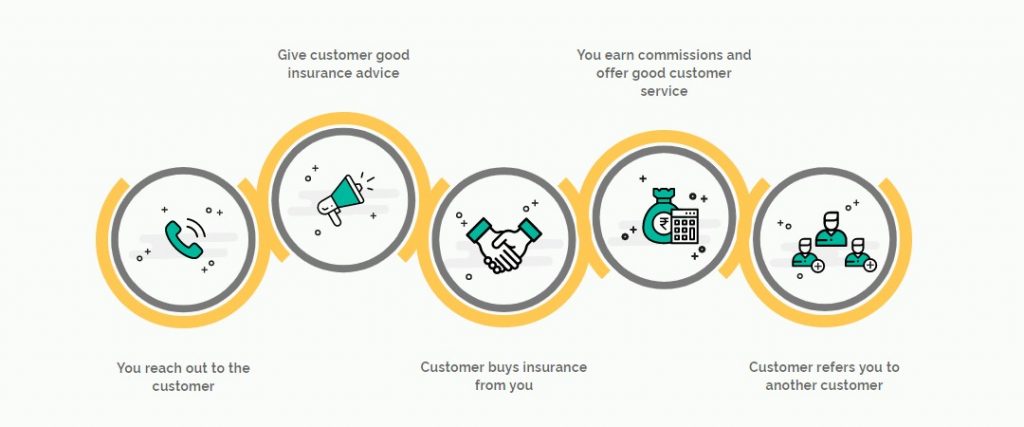

LIC Agent is a person who promotes life insurance policies floated by LIC to their customers within and outside their social circle. LIC Agents are not employees, LIC Agency is a form of self-employment or Business with unlimited income earning opportunities. As this is not a job so anyone can join this profession as a side income opportunity along with their private job or business. LIC also absorbs their performing agents into corporation as an employee or Development Officer by giving them some relaxation during the selection process. The process flow of LIC Agent duties are described below:

LIC sales training includes Basic knowledge and complete information about LIC Plans, Objection handling & satisfying customer needs, Knowledge about other competitive instruments available in the market, after sales services & Learning about how to take references from old customers and Big Premium Policy selling to HNI Customers.

Basic Knowledge About LIC Plans

Every aspects of life insurance are described from the basics. Our introductory training session includes basic knowledge of insurance terminologies like Sum Assured, how to calculate Bonus and Final Addition Bonus in a policy, commission structure in different LIC policies, information about different LIC Plans & it selling aspects, identification of client needs, plan presentation and sales closing techniques.

Objection Handling:

When we talk about objection handling in sales, it’s a very important aspect of any sales process whether its insurance selling or any other product or utility selling. Whenever any new sales person interact with clients, the biggest obstacles to closing new business comes in the form of managing customers objections. Objections are inevitable but should never be seen as a door slamming closed in your face.

The key is to understand why the customer is objecting and presenting the solution in the form of products as per their needs. In the first session of training of LIC Plans we discussed and trained our agents about the possible objections and its solutions so that they will be able to answer every objections and queries of the clients at that time only. Our product training & objection handling sessions are the key for the success of our trained agents.

Knowledge About other Competitive Products:

Other competitive products include Insurance policies from private insurers, Post office schemes like Sukanya Samriddhi Scheme, PPF, Kisan Vikas Patra (KVP), National Savings Certificate (NSC), Postal Life Insurance and knowledge about Mutual Fund. Although some of these products don’t provide the benefits of risk coverage and some provides only partial tax saving benefits but proper knowledge of these products in comparison of our LIC Policies are must.

After Sales Service & Referral Market:

After sales service is a very important aspect of our business. In Life insurance business service is not of one time, it’s a long-term commitment for agent till policy continues. A “Satisfied customer is the best source of advertisement” and provides references to the agents. Reference taking is also a type of technique and once an agent learnt this technique than he can reach the height of selling as referral is a never-ending process.

Policy to HNI Customers:

In the advance level training programs, we teach our agents about selling policies to HNI Customers which includes concept selling. Concept selling is a form of selling multiple policies with different features to one customer satisfying their all needs at different stages of life. These policies are also known as “Combo Plans”. Once an agent learnt the art of combo selling then this leads him to sell big premium policies and entitled them for club membership and various other benefits from the corporation.