Which Tax Slab to Choose for ITR Filing According to Income: Regime 1 or Regime 2 and How LIC Policy Can Give Benefit of Tax Savings

When it comes to filing income tax in India, the decision between income tax regime 1 & 2 is crucial for maximizing your savings. Selecting the right tax slab not only impacts your tax liability but also determines how effectively you can leverage financial instruments such as LIC policies for tax benefits. In this blog, we’ll break down the differences between the two regimes, provide examples for income groups ranging from ₹12 lakh to ₹50 lakh per annum, and highlight how Section 80C of insurance benefits in tax can save you significant amounts.

Understanding Income Tax Regime 1 & 2

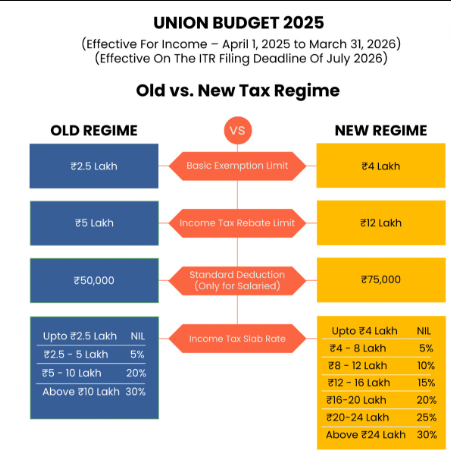

India offers two types of tax regimes for salaried and non-salaried individuals: Regime 1 (Old Tax Regime) and Regime 2 (New Tax Regime).

- Regime 1 (Old Tax Regime) allows taxpayers to claim deductions such as Section 80C, 80D, and insurance premiums. This regime is suitable for individuals who invest in tax-saving instruments like LIC policies, PPF, and ELSS.

- Regime 2 (New Tax Regime) offers lower tax rates but does not allow most deductions or exemptions. It’s beneficial for those who prefer simplicity and do not have many tax-saving investments.

By understanding these regimes, you can make an informed decision on whether to claim tax benefits using income tax save strategies or opt for the lower rate structure.

LIC Policy: A Key to Tax Saving in Regime 1

One of the most effective ways to reduce taxable income under income tax regime 1 is through LIC policies. Premiums paid towards LIC insurance plans are eligible for deductions under Section 80C of insurance benefits in tax, up to ₹1.5 lakh per year.

For example:

- If you earn ₹12 lakh per annum and invest ₹1.5 lakh in LIC, your taxable income reduces to ₹10.5 lakh.

- The tax saved on this investment depends on your marginal tax rate. For a 30% slab, this can save up to ₹45,000 annually.

LIC policies not only provide life coverage but also act as a disciplined investment vehicle, combining protection with tax efficiency.

Comparing Tax Impact for Income ₹12 Lakh Per Annum

Let’s analyze an income of ₹12 lakh under both regimes:

Regime 1 (Old Regime with 80C deductions):

- Gross Income: ₹12,00,000

- LIC Premium Deduction (Section 80C): ₹1,50,000

- Taxable Income: ₹10,50,000

- Tax Payable: Approx ₹1,12,500

Regime 2 (New Regime without deductions):

- Gross Income: ₹12,00,000

- Taxable Income: ₹12,00,000

- Tax Payable: Approx ₹1,35,000

Savings using LIC in Regime 1: ₹22,500

Clearly, investing in LIC under income tax regime 1 provides substantial tax savings for middle-income earners.

Comparing Tax Impact for Income ₹50 Lakh Per Annum

High-income earners can also benefit significantly from LIC policies:

Regime 1 (Old Regime with deductions):

- Gross Income: ₹50,00,000

- LIC Premium Deduction (Section 80C): ₹1,50,000

- Taxable Income: ₹48,50,000

- Tax Payable: Approx ₹13,50,000

Regime 2 (New Regime without deductions):

- Gross Income: ₹50,00,000

- Taxable Income: ₹50,00,000

- Tax Payable: Approx ₹14,00,000

Savings using LIC in Regime 1: ₹50,000

For high earners, choosing Regime 1 with strategic LIC investments can provide notable tax relief while securing life insurance benefits.

Section 80C of Insurance Benefits in Tax Explained

Section 80C allows deductions on certain investments, including LIC premiums. Features include:

- Maximum deduction limit: ₹1.5 lakh per financial year

- Eligible instruments: LIC policies, PPF, NSC, ELSS, and other notified savings schemes

- Tax saving directly reduces your taxable income, unlike rebates or exemptions

By investing in LIC, you not only secure life insurance but also reduce your income tax liability in a legally compliant way, making it one of the most trusted instruments for income tax save purposes.

LIC History: Trustworthy Partner in Tax Planning

Life Insurance Corporation of India (LIC) was established in 1956, and since then, it has become a pillar of financial security for millions. With decades of experience, LIC offers a wide range of policies including term insurance, endowment plans, and ULIPs, all eligible for Section 80C of insurance benefits in tax.

LIC’s long-standing reputation ensures policyholders can rely on both risk protection and financial growth, making it an ideal tool for tax planning under income tax regime 1 & 2.

Why Join LIC as an Agent: Boost Income and Help Others Save Tax

Becoming an LIC agent allows you to guide clients on choosing the right insurance products while earning attractive commissions. Key benefits include:

- Helping clients optimize tax savings using Section 80C of insurance benefits in tax

- Flexible work hours and potential for a second income

- Building trust and long-term client relationships

- High earning potential with incentives on policies sold

For anyone interested in financial planning and tax consultancy, joining LIC provides both professional growth and the satisfaction of enabling clients to save taxes efficiently.

How to Decide Between Regime 1 & Regime 2

Choosing the right regime depends on your investment habits:

- Choose Regime 1 if you invest in LIC or other tax-saving instruments. You get the benefit of deductions and can save more tax.

- Choose Regime 2 if you do not have significant investments or prefer lower tax rates without exemptions.

Example:

- Income: ₹25 lakh

- LIC Premium: ₹1.5 lakh

- Regime 1 Tax Payable: ₹6,37,500

- Regime 2 Tax Payable: ₹6,50,000

- Net Savings using LIC: ₹12,500

Even for higher incomes, income tax regime 1 & 2 comparison clearly shows the advantage of strategic investments like LIC for tax efficiency.

Practical Tips for Maximizing Tax Savings

- Invest in LIC early to claim full Section 80C of insurance benefits in tax.

- Keep receipts and documents handy for ITR filing.

- Consider combining LIC with other 80C instruments like PPF or ELSS.

- Review your annual income and tax slab to decide between Regime 1 & Regime 2.

- Seek professional guidance from LIC agents or financial advisors for optimal planning.

Conclusion: Choosing the Right Tax Slab and LIC for Maximum Benefit

In conclusion, understanding income tax regime 1 & 2 is essential for effective tax planning. For income groups ranging from ₹12 lakh to ₹50 lakh per annum, strategic LIC investments can significantly enhance income tax save opportunities through Section 80C of insurance benefits in tax.

LIC policies not only protect your loved ones but also help you legally reduce taxable income. Choosing Regime 1 and investing in LIC can be a smart way to balance financial security with tax efficiency, while also giving you insights into why joining LIC as an agent can be a rewarding career path.